Getting The Clark Wealth Partners To Work

Table of ContentsAll About Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisClark Wealth Partners Fundamentals ExplainedThe Ultimate Guide To Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Should KnowClark Wealth Partners for Dummies

These are professionals that give investment advice and are registered with the SEC or their state's securities regulatory authority. Financial consultants can additionally specialize, such as in student car loans, elderly demands, taxes, insurance policy and various other facets of your funds.Just financial experts whose designation needs a fiduciary dutylike certified financial organizers, for instancecan say the exact same. This distinction likewise suggests that fiduciary and monetary expert fee structures vary also.

Unknown Facts About Clark Wealth Partners

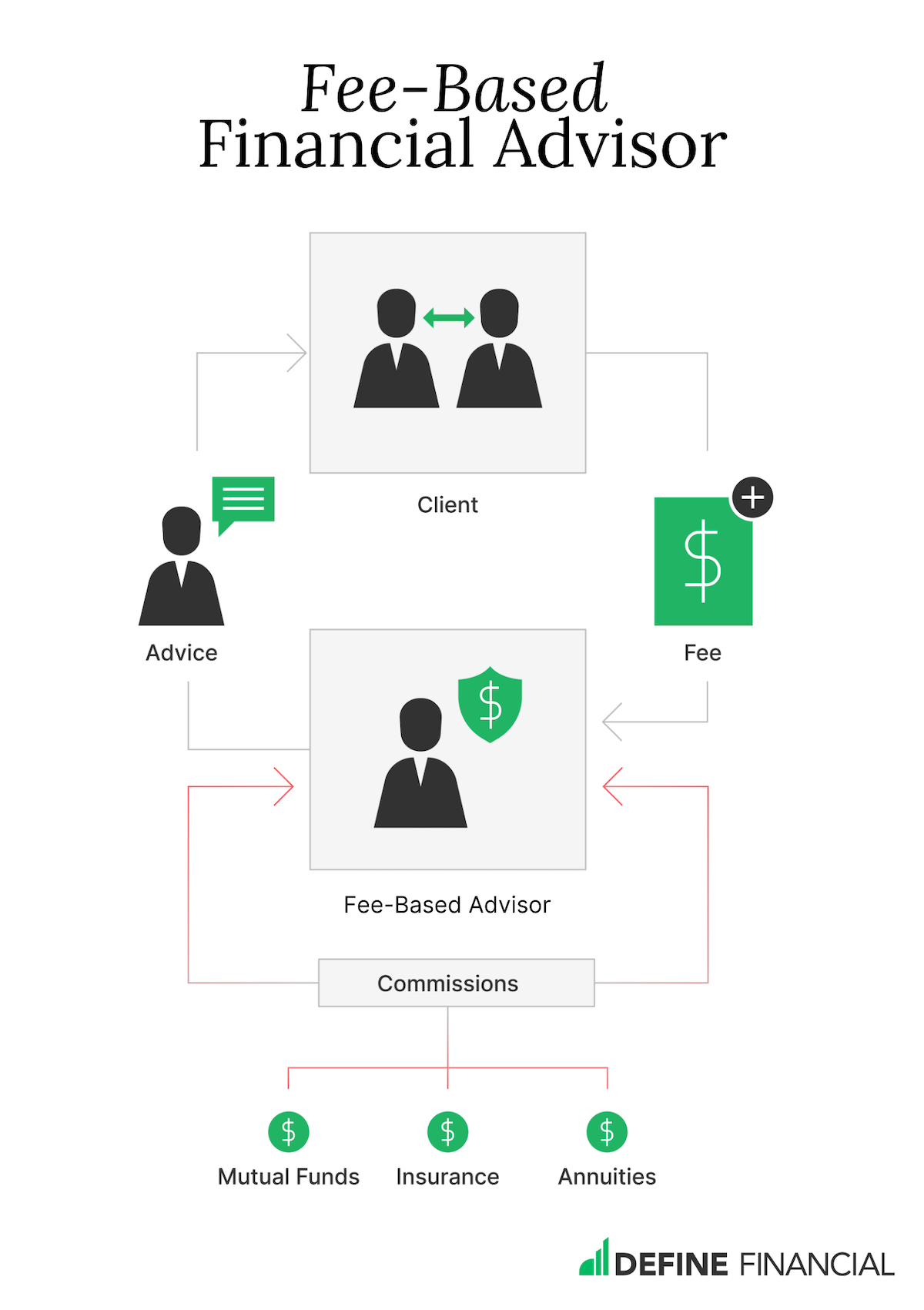

If they are fee-only, they're more probable to be a fiduciary. If they're commission-only or fee-based (meaning they're paid through a combination of charges and commissions), they could not be. Many credentials and classifications need a fiduciary responsibility. You can inspect to see if the professional is registered with the SEC.

Choosing a fiduciary will certainly ensure you aren't steered towards particular investments as a result of the compensation they supply - financial planner in ofallon illinois. With great deals of cash on the line, you might desire an economic expert who is legally bound to make use of those funds meticulously and just in your best interests. Non-fiduciaries may recommend investment products that are best for their pocketbooks and not your investing goals

Get This Report on Clark Wealth Partners

Increase in cost savings the typical home saw that functioned with a financial expert for 15 years or even more compared to a comparable home without a financial expert. "Extra on the Value of Financial Advisors," CIRANO Job Information 2020rp-04, CIRANO.

Financial advice can be valuable at transforming factors in your life. Like when you're beginning a household, being retrenched, intending for retired life or handling an inheritance. When you meet look what i found a consultant for the very first time, function out what you want to obtain from the guidance. Prior to they make any recommendations, a consultant must make the effort to review what is very important to you.

Things about Clark Wealth Partners

When you have actually concurred to go ahead, your economic advisor will certainly prepare an economic prepare for you. This is provided to you at an additional conference in a paper called a Declaration of Advice (SOA). Ask the adviser to clarify anything you don't understand. You need to constantly feel comfortable with your advisor and their recommendations.

Urge that you are alerted of all deals, and that you receive all document pertaining to the account. Your adviser might recommend a managed discretionary account (MDA) as a method of handling your financial investments. This involves authorizing an arrangement (MDA contract) so they can get or market financial investments without needing to contact you.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

To protect your money: Don't give your consultant power of attorney. Insist all communication concerning your financial investments are sent out to you, not just your adviser.

This may happen during the conference or electronically. When you go into or restore the recurring charge arrangement with your advisor, they must define just how to end your partnership with them. If you're relocating to a brand-new consultant, you'll require to arrange to transfer your economic records to them. If you require aid, ask your consultant to clarify the process.

will certainly retire over the following decade. To fill their footwear, the nation will require greater than 100,000 new economic advisors to get in the industry. In their daily work, economic experts take care of both technical and creative tasks. United State News and World Record ranked the duty among the leading 20 Best Business Jobs.

The Best Guide To Clark Wealth Partners

Assisting individuals accomplish their financial goals is a monetary advisor's main function. They are also a tiny organization owner, and a section of their time is dedicated to handling their branch office. As the leader of their method, Edward Jones economic consultants require the leadership skills to hire and take care of personnel, as well as business acumen to produce and carry out an organization method.

Investing is not a "collection it and neglect it" task.

Financial advisors must set up time each week to satisfy brand-new individuals and catch up with the people in their sphere. Edward Jones monetary consultants are lucky the home office does the heavy lifting for them.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Proceeding education is a required component of maintaining a monetary expert certificate (Tax planning in ofallon il). Edward Jones financial advisors are encouraged to pursue additional training to expand their knowledge and skills. Dedication to education and learning secured Edward Jones the No. 17 place on the 2024 Training peak Awards checklist by Educating magazine. It's additionally an excellent concept for economic consultants to go to market conferences.